In the last six years National has done more to address working-age welfare dependence than Labour did in the prior nine. However their reforms shouldn’t be overcooked. Describing them as a “useful start” in his recent autobiography, Don Brash was spot on.

A Labour supporter would reject my opening statement on the basis that numbers on the unemployment benefit took a nosedive over their incumbency. Absolutely true. Work and Income put enormous effort into those on an unemployment benefit and Labour luckily oversaw a good economic patch (their responsibility for which was probably as genuine as National’s for the GFC).

But chronic welfare dependence, a crippling social and economic issue for New Zealand, lies in the other main benefits: pre-reform they were the DPB and Sickness/Invalid benefits combined.

To their lasting credit, in 2009 National set up the Welfare Working Group, and from there, commissioned the Taylor Fry actuarial work which exposed where long-term reliance is concentrated. The revelation that teen parents and other young beneficiaries entering the system at 16 or 17 would stay there the longest was no surprise to me.

Through the early 2000s, although only 2-3 percent of the DPB total at any given time were teenagers, between a third and a half had begun there as teenagers. I’d been arguing throughout Labour’s administration that average stays on welfare were much longer than government issued figures. Point-in-time data produces much longer averages than data collected over a period of time, but it suited Labour to use the latter data to minimise average stays. To understand this statistical phenomena imagine a hospital ward with 10 beds. Nine are occupied year around by chronically ill patients; one is occupied on a weekly basis. At any point-in-time 9 patients had an average stay of 12 months and one an average stay of one week. But calculated over the year, 85 percent of total patients had an average stay of just 1 week. Equate this to spells on welfare and you can see how long-term dependence can be minimised.

Here is the huge difference between National and Labour.

National looked for what Labour had denied.

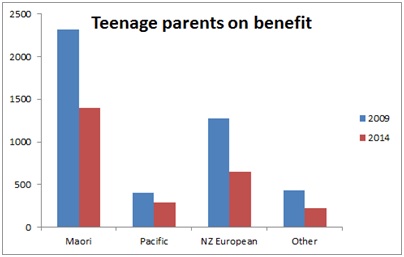

Their discovery has led to a radically different approach to youth and young parents. Intensive mentoring and income management have seen the numbers of young people on welfare plummet. The teenage birth rate has been falling since 2008, and as virtually all single teen parents go on welfare, benefit dependency levels have consequently fallen. The reforms must be playing some part. How much is probably unquantifiable.

With the inflow into the benefit system stemmed, future reductions in every associated negative outcome can be expected. That means fewer childhood health and educational non-achievement problems; fewer youth criminal apprehensions and convictions; and lower prison populations.

It is especially telling that there are no promises from Labour or the Greens to undo this new regime.

In fact Labour has advocated more income management. Their 2014 ‘Social Development’ policy paper advocates, “…allow[ing] income management to be used as a tool by social agencies where there are known child protection issues and it is considered in the best interests of the child, especially where there are gambling, drug and alcohol issues involved.”

This endorses National’s intention – given another term – to extend income management to other beneficiaries who are not providing basic necessities of their children.

Unfortunately, though, that is where the accord ends.

Without religiously spelling out which party is responsible for which policy, the road ahead under a Labour/Green/Internet-MANA government would likely involve:

1/ Paying the parental In Work Tax Credit (IWTC) to out-of-work parents.

The Greens have disguised the extension of this tax credit as:

“A new Children’s Credit that will give an extra $60 a week to families currently missing out, at a cost of $400 million a year.”

Unsurprisingly this isn’t a popular policy amongst some of their own and Labour’s low-income constituents who are working hard for the extra payment.It was Clark and Cullen who created the IWTC. That the Greens and Labour now want to destroy the margin between parental income from employment and income from a benefit demonstrates how much further left this group would be.

2/ Restoring the Training Incentive Allowance (TIA) to career beneficiary students who have become addicted to studying and want the taxpayer to fund their PhDs.

Minister for Social Development, Paula Bennett, abolished the TIA and moved the funding into efforts to get younger people to achieve lower level qualifications. Treasury advised that use of the TIA led to longer stays on welfare.

3/ Lifting abatement-free thresholds to $150 weekly on every benefit.

This is ostensibly to allow beneficiaries to earn more from work while not losing benefit cash thereby encouraging part-time work. In fact it makes it is much more difficult for individuals to get off the benefit because the combination of benefit and work pays more than work alone.

4/ Under the guise of solving child poverty, paying people on welfare far more for producing babies – eg Labour’s Best Start policy.

Higher benefits increase the rate of unmarried births, already a major source of child poverty.

5/ Raising minimum wages.

Internet-MANA have outbid both the Greens and Labour with a promise of $18.80 hourly (ditto the Maori Party).

While not strictly a ‘welfare policy’ the Left say this move will make work more viable (ignoring the moral case for employed independence) and ease childhood poverty. Yet in their recently published book Child Poverty in New Zealand left-leaning Professor Jonathan Boston and economist Simon Chapple discussed lifting minimum wages/ implementing a living wage and concluded:

“In short, the living wage proposal, whether implemented via an increase in the statutory minimum wage or through voluntary actions in particular sectors or industries, will do little to solve child poverty in New Zealand.”

This is primarily because most people on the minimum wage aren’t parents. Additionally, the authors accept that the resulting higher unemployment will push more people into or back to the benefit system.

Broadly speaking then, a government made up of Labour, the Greens, and Internet-Mana (with the possibility of support from the Maori Party and/or NZ First) would redistribute billions more and almost certainly increase dependence on state welfare.

A quick trip down memory lane will remind us of what welfare has achieved:

- A huge increase in sole parent families with dependent children from around 3% in the 1970s to 30% today.

- A horrible legacy for people made redundant in recessions like that of the early 1990s. Unlimited welfare let people languish and develop more than just joblessness. The constant debate in the United States is whether their time-restricted unemployment benefits should or shouldn’t be extended for this reason.

Which brings me to 2 major problems which no party (bar ACT) is talking about:

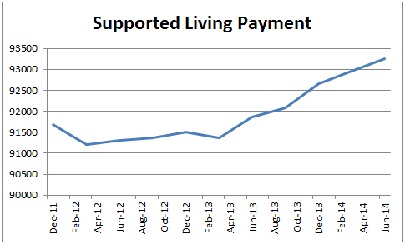

The Invalid Benefit (now the Supported Living Payment) continues to grow in numbers

A recent MSD report states:

” A higher than expected rate of transfer to Supported Living Payment is also occurring from both Jobseeker – HCID and Sole Parents.”

Back in the 1960s around 1 percent of the population was ‘permanently’ incapacitated. That now stands at over 3% – small percentages but large absolute numbers.

The single largest reason for incapacity is psychological and psychiatric conditions. The recent spate of tragic violence, repercussions and earlier threats to Work and Income staff are almost certainly due to mental ill health. (In 2009, people on an Invalid Benefit made up the majority of those allocated to the Remote Client Unit because they had been trespassed for violence or aggression.)

The late 1980s policy to close psychiatric institutions and support mentally ill people within the community was very well-intentioned but has wrought new problems which politicians seem to be ignoring.

Children are being added to an existing benefit at an even greater rate than pre-reform

National’s early sole parent work-testing policy intended to reduce this habit but has thus far failed. Female beneficiaries – particularly Maori – continue to have babies when they are already unemployed and without independent means to raise their children. In the six months ending March 31, 2006, 5854 children aged under one were added directly to a benefit. In the same period prior to March 2014 the number increased to 6634 – a 13% rise.

And many thousands more will become benefit-dependent by the end of their birth year.

The ACT Party, promising continuing support to a National government, seeks to address these deeper problems with the following policy:

“Introduce a life-time limit of 5 years for support under the Sole Parent programme (as the US did in the nineties), and a life-time limit of 3 years for support under the Jobseekers Benefit, with “income management” (as currently applies to those on the Youth Payment and Young Parent Payment benefits) when those limits are reached.”

The advantage of such a regime is expectations are clear and simple. Limits would incentivise people to save up entitlements rather than simply defaulting to (currently) open-ended benefits.

As it stands many workless rural communities rely heavily on welfare. Work-testing is somewhat meaningless. People can remain in these small towns generation after generation. Ironically the only recent leader who has verbalised this problem was Helen Clark when her government introduced a policy to prevent people on the dole from moving into these ‘dead’ areas. As touched on earlier though, that administration was far more conservative and centrist than a new Left government would be.

Every election the Greens use children to promote robbing Peter to pay Paul. This time Labour has joined in. Both refuse to recognise that the easy quick fix of transferring greater sums into non-working homes will make people more dependent and inevitably, poorer. The prospect is depressing and frightening.

The alternative is National gaining a third term and the opportunity to cement in the reforms that are working and reappraise any that aren’t. With the support and influence of ACT and possibly the Conservative Party (Colin the-best-welfare-program-is-a-job Craig) who share strong family, small government values, much more could be possible.