Irresponsible sabotage or keeping the market fully informed? As anyone who has followed politics closely will know, there is no doubt that the coincidentally timed announcement by the Labour and Green parties to nationalise the wholesale electricity industry was designed to materially impact on the sale of Mighty River Power shares.

Irresponsible sabotage or keeping the market fully informed? As anyone who has followed politics closely will know, there is no doubt that the coincidentally timed announcement by the Labour and Green parties to nationalise the wholesale electricity industry was designed to materially impact on the sale of Mighty River Power shares.

They could have announced the issue some months ago, before the float had commenced. Instead they chose to do so after the offer price range had been set and after applications had opened. Given the materiality of the radical proposals, the government had no choice but to suspend the offer, give those investors who had applied the opportunity to withdraw their share application, and restate the risks associated with the investment. It has in effect, derailed the offer by spooking investors.

Last week’s policy announcement has also demonstrated just how reckless and selfish Labour and the Greens are. They are prepared to destroy private sector wealth creation and competitive free markets to advance their own political careers. Not only have they diminished the value of power companies, but they have sent a telegram to all overseas investors that New Zealand is a high risk country. Those investors will no doubt adjust upwards their risk return assessments and demand higher returns from any future investments they may make in this country. That may include overseas banks financing domestic mortgages.

Whether one likes foreign investment or not, the fact is that without it, there would be fewer jobs and less economic activity. While that will not hurt well paid politicians in Wellington, it will hurt workers and the families who rely on their incomes.

Mark Warminger, a Portfolio Manager with Milford Asset Management has quantified the potential damage of the Labour-Green proposal: “…to save $700m per annum from our total electricity bill the direct and indirect costs of such a scheme would be in the order of the following; $2.5bn in additional debt servicing costs, $450m reduction in dividends, $4.5bn asset write-downs from State owned enterprises, $1bn of capital destruction of the listed power companies and a reduction of $100m of dividends per annum to New Zealand shareholders. In addition, there will be highly skilled jobs lost as power companies reduce capital expenditure and development. In the short term this will not be an issue whilst demand catches up with supply but by the time supply and demand are in balance it will be too late to add additional capacity in a timely manner. ”1

According to TV3 News, JBWere, a firm which manages $1 billion of client funds in our share market, has signalled that it and other investors will leave the New Zealand stock market if the state intervention signalled by Labour and the Greens becomes a reality: “The steps the Labour/Greens are suggesting, if enacted, are significant enough for JBWere to consider a reduced allocation to the local share market. We doubt we would be alone in making this judgment”.2

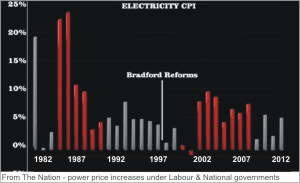

Labour and the Greens tried to justify their announcement by claiming that the electricity market is not working and that the cause is the failure of the reforms introduced by Max Bradford and the National Government in 1998. The facts, however, tell a different story as the above graph of annual increases in consumer electricity prices show. The latest round of price-rise problems were clearly caused by Labour’s re-regulation of the electricity market in 2002.

For anyone who does not understand just how disastrous it would be if politicians were in charge of the highly complex electricity market, consider what our supermarkets would be like if they ran them too! This is no less illogical than controlling electricity pricing and not outside the realms of possibility given that the former Venezuelan President, the late Hugo Chavez, a hero of the Green Party, nationalised supermarkets in 2010 over accusations of price gauging.

That is not to say there are no problems with the electricity industry and the price of power – of course there are. The New Zealand Centre for Political Research has explored the issue often enough as we have tried to highlight the underlying forces that are driving power price increases. But never in our wildest dreams did we imagine the Labour Party would embrace the wacky ideas of the deeply socialist Green Party as their own on such an important issue. For Labour to do so shows how far they have drifted to the left – not even Helen Clark would have been so reckless.

Within two days of the Labour-Green announcement, the sharemarket value of Contact Energy, Trust Power and Infratil had fallen by almost $600 million. That loss will be felt by mum and dad investors who have part of their retirement nest-egg squirreled away in such listed companies, as well as the 2 million New Zealanders who have KiwiSaver accounts. In addition, all New Zealanders will suffer a loss via the New Zealand Super Fund and ACC’s investment fund.

All New Zealanders will also lose out because this ill-timed missile will no doubt diminish the issue price of Mighty River Power shares. That means less money for debt repayment, hospitals and schools. In other words, it is sick people and children who will bear the brunt, which says a great deal about Labour and Green MPs.

Labour and the Greens have justified their state control policy by claiming they are concerned about the impact that the rising cost of power is having on households. What they of course don’t say is that they are responsible for much of that increase. During the nine years that Labour (supported by the Greens) was in office power prices increased by 72 percent. They have subsequently risen by 20 percent since National has been in office.

Two of the main reasons for the power price increases – as our own research over the last few years has shown – are the government’s energy strategy and the Emissions Trading Scheme.

Although New Zealand is a world leader in the production of electricity from renewable sources, in 2007 the Labour Government (and its Green support partner) launched a new energy strategy which required 90 percent of the country’s electricity to be generated from renewable sources by 2025. In addition, a 10-year moratorium on the building of new fossil fuel base load power generation plants was introduced. As a result, there was a massive switch within the industry towards more expensive ‘renewable’ electricity generation (windmills) which pushed up the cost of power.

The Emissions Trading Scheme is another green policy that was introduced the dying days of the Labour administration. Designed to penalise New Zealanders for the production of greenhouse gases, it has also pushed up the price of electricity by introducing a surcharge onto the stationary energy sector in 2010 that was estimated to increase the amount that consumers would pay for power by $400 million. At the same time, an ETS surcharge of 3.5 cents a litre was added to the price of fuel.

These ETS increases, which have worked their way through the whole economy to increase the cost of goods and services across the board, are the worst form of bureaucratic cost impost, since the benefits provided by the ETS are non-existent. The fact that the scheme remains in place is a testament to some misguided political belief that penalising New Zealand consumers and businesses is somehow going to save the planet.

The ETS was, of course, introduced after the Labour Government signed the Kyoto Protocol in 2002 and tied New Zealand to a binding commitment to reduce greenhouse gases to 1990 levels between 2008 and 2012 – even though the whole idea was completely barmy given that almost half of our greenhouses gases are produced by cattle and sheep. Once the Kyoto Protocol expired, at the end of 2012, New Zealand pulled out, but instead of disestablishing the costly ETS, National has left it in place – just like they left in place Labour’s unachievable 90 percent renewable energy generation goal in their Energy Strategy, instead of replacing it with a more sensible option.

Since Kyoto expired, carbon prices around the world have crashed. In the European Union last week the price hit junk bond status – falling from nearly €30 a tonne in 2008 to €2.47 after the European Parliament voted against propping up the price. In 2011, the Swiss Bank UBS produced a report for investors claiming that the EU’s emissions trading scheme had cost the continent’s consumers €210 billion for “almost zero impact”.3 Goodness knows what the ETS has really cost New Zealand – not just in the rising cost of power, fuel and all other goods and services (including a new surcharge on rubbish collection now that the waste sector has entered the ETS), but in the loss of jobs through businesses closing and relocating overseas; such figures are almost impossible to find.

But the carbon price crash is not the only change. Stalwart supporters of global warming are now starting to question the theory itself given that global temperatures have not risen for over 15 years, in spite of computer models showing that temperatures should be rising in step with carbon dioxide. They are realising that not only are the models wrong, but so too are the scary scenarios which the models generate. Even prestigious publications such as The Economist are starting to question the competency of climate models and the groups that promote alarmist scenarios. Certainly the public are becoming more sceptical, which is heartening, given the steady diet of doom and gloom that is being dished out by many media outlets.

This week’s NZCPR Guest Commentator is Professor Roger Bowden, an economist who has long followed developments in climate change and global warming theory. In his article Climate change and the social importance of scepticism, he explains how ideological intolerance is a major threat to an open society:

“Take global warming… It all looked convincing to me. But the doubts started to creep in. As a mathematical modeller myself, I was uneasy about the faith being placed in the causal models. Given his outstanding mathematical modelling credentials, it was hard to dismiss the negative assessment of Freeman Dyson, of Princeton University, as out of date or over the hill. And at the outset I was just a little worried by the curve, which appeared to show that global temperatures were leading CO2 rises, not the other way round. And any unusual weather pattern, it seemed, was grist to the mill for the climate correctness industry.

“Moreover as an economist, the motives for professional capture became progressively more apparent. By that I do not mean just money, consultancy, or at one remove, government funding for me and my team. Scientists enjoy public attention and social importance just as much as the next man, or woman. But I also became troubled by the intolerance of opposing views that had started to develop. Climate change and its mechanism became a ‘done deal’ in the media, as though no socially responsible person could possibly think otherwise.”

Professor Bowden concludes his article with a warning – that the suppression of dissenting voices by ideologically-driven bullies does society a real disservice. He also contends universities in particular have a responsibility to remain open minded to the claims of sceptics, knowing that opposing views lie at the heart of critical thinking.

Without a doubt we should apply this same logic to parliament and politics. Dissenting voices in popular debates should be treated with respect instead of vilification. If we are to nurture an open society then it is crucial that all sides of an argument are encouraged to speak out. Those that do so should not be criticised nor ridiculed for expressing their view – that should be reserved for the bullies that attack them personally instead of addressing the issue!

- 1.Mark Warminger, Rolling blackouts could be our future ↩

- TV3, JBWere predicts capital flight ↩

- Australian, Europe’s $287bn carbon ‘waste’: UBS report ↩