The Child Poverty Action Group (CPAG) has a list of goals it believes will improve outcomes for New Zealand children. While not an exact match for what the Expert Welfare Advisory Group recommended, they form a generic prescription typically employed by ‘anti-poverty’ activists to pressure government into greater wealth redistribution. While I accept the advocacy is well-meant, good intentions don’t necessarily equal good outcomes. And there is a touch of cynicism on my part whenever children are used to promote socialist goals.

The CPAG goals are:

- Substantially improve core benefits;

- Remove harsh sanctions that impact on children;

- Ensure that all benefits and all part of Working for Families (WFF) are indexed annually to prices and wages;

- Remove the hours of paid work criteria from the WFF In-Work Tax Credit and extend it to all low-income families;

- Treat adults in the benefit system as individuals without penalising them for being in a partnership;

- Focus on what will give children better outcomes and less on moving their carers into paid work; and

- Ensure that applicants receive all the assistance to which they are entitled.

Each of these goals is addressed below:

Substantially Increase Core Benefits

Sole Parent Support basic weekly rate is $340 net. The rate is the same for a sole parent on Jobseeker support. A couple on Jobseeker support with children receive $195.50 each.

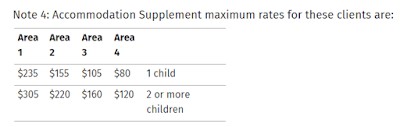

It is impossible to consider basic rates without taking into account accommodation subsidies:

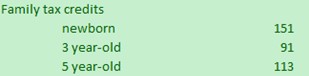

And tax credits for children of beneficiaries:

(The new IRD site does not publicise rates but these were current in 2018.)

There’s not a lot of point in tallying possible incomes but you can see that the components above and beyond the core rate are significant.

Undoubtedly life on a benefit is tough but, for the large majority, it is supposed to be a temporary state of affairs. When the margin between income from working and welfare is reduced, the risk of dependency is increased. No study I am aware of has ever shown children in long-term benefit dependent homes have better outcomes.

Remove Harsh Sanctions That Impact On Children

Sanctions exist to ensure that beneficiaries meet their obligations. We all have obligations, whether to our partners, employers or employees. That’s the real world. We wouldn’t adopt a general attitude that people with children should be exempt from obligations and it shouldn’t be applied in the world of welfare.

If a beneficiary is not meeting Work and Income obligations, what obligations to their children are they failing? Incurring sanctions is a marker of greater dysfunction in the parent’s life. If they can’t keep an appointment with their case manager, do they keep appointments with their child’s GP? An inability to meet obligations should call for more intervention, not less.

Ensure That All Benefits And All Part Of Working For Families (Wff) Are Indexed Annually To Prices And Wages

The first part of this goal has already been legislated for by the current government. If workers collectively earn annual wage growth, benefits will rise by the same margin. Not all are happy with this idea. Workers object in the same way they objected to Labour’s promise to give the In Work Tax Credit to beneficiaries during the 2014 general election campaign. Again the incentive to work is being whittled away.

Remove The Hours Of Paid Work Criteria From The Wff In-Work Tax Credit And Extend It To All Low-Income Families

The CPAG has fought for this through repeated court cases and lost. It was the 1999 – 2007 Labour government that created the in-work tax credit with the explicit purpose of getting beneficiaries – especially sole parents – into work. The Clark administration believed that the best way out of poverty is through work. But working has other benefits too. It provides purpose, social contacts (not to mention romantic partners), and self-esteem. It also role models expectations to children. Its removal would further erode incentives to seek paid employment.

Treat Adults In The Benefit System As Individuals Without Penalising Them For Being In A Partnership

In 2018 economist and social policy advisor Michael Fletcher was commissioned by Superu to investigate individualising entitlements in New Zealand’s benefit system. He modelled changes that “… suggest the cost of individualising all entitlements would be in the order of $1.5 billion to $2 billion.” But he also cites forthcoming work from Anderson and Chapple that estimates individualisation would cost several billion dollars per annum. A Universal Benefit Income would achieve the same end. In 2010, when Treasury modelled a UBI of $300 per week for all individuals aged 16 and over, it identified a $45-57b annual price tag (which would replace the current $27 billion cost.)

What did Churchill say? Something about a society trying to tax itself into prosperity is like a man trying to lift himself up by the handle of the bucket he is standing in? He might as well have a child in the bucket with him. The same would still be true.

Focus On What Will Give Children Better Outcomes And Less On Moving Their Carers Into Paid Work

So many studies on so many outcomes have shown children do better with two parents. Having two parents improves outcomes even when income is low. The two-parent family was the prevalent type before we began subsidising single parents.

Notwithstanding, some children are better off with just their mother or father, and a period of being supported by the taxpayer to stabilise a family situation doesn’t present a problem. But again it should be temporary. Carers should be looking to work to provide for their children.

Ensure That Applicants Receive All The Assistance To Which They Are Entitled

Which should be the case, as should ensuring parents on a benefit are meeting all their obligations eg trying to find a job. Surely it’s a two-way street? But CPAG disagree as per their prior goal calling for the abolition of sanctions.

…

It isn’t at all clear to me what this brave new world of bigger benefits with no strings attached is going to do for children. Money can’t buy love. In fact unconditional money finances lifestyles that are not conducive to happy and safe childhoods.

MSD research from 2017 showed that children who had spent 80 percent or more of their first two years on a benefit were 38 times more likely than a child with no benefit history to have a finding of abuse.

As a society we should be encouraging employed, two parent families as the best environment in which to raise children. Not the opposite.